Payback period calculation formula

Step 2 Calculate the CAC Payback Period. Written out as a formula the payback period calculation could also look like this.

Payback Period Method Double Entry Bookkeeping

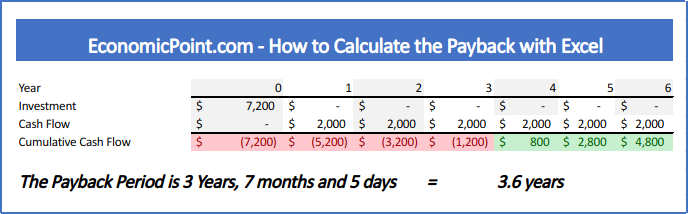

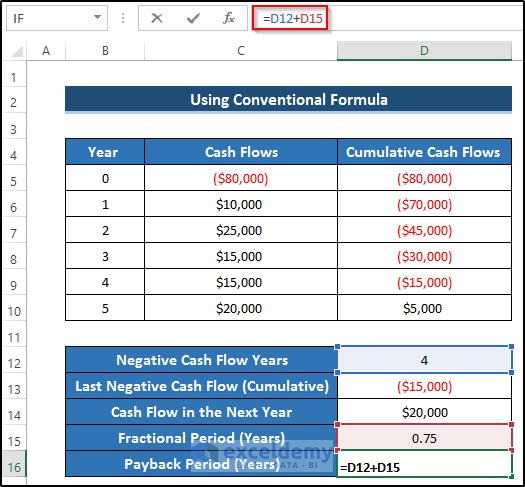

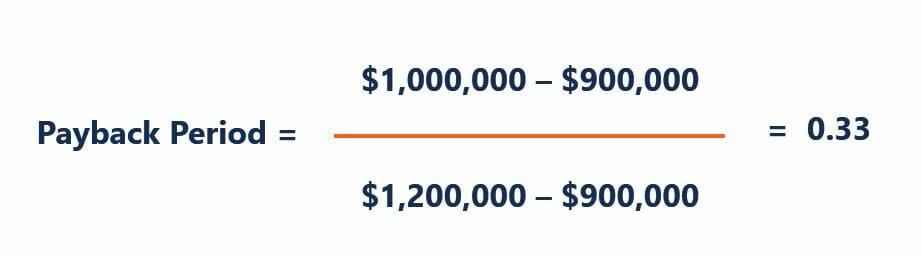

Payback Period Years Before Break-Even Unrecovered Amount Cash Flow in Recovery Year Here the Years Before Break-Even refers to the number of full years until the break-even.

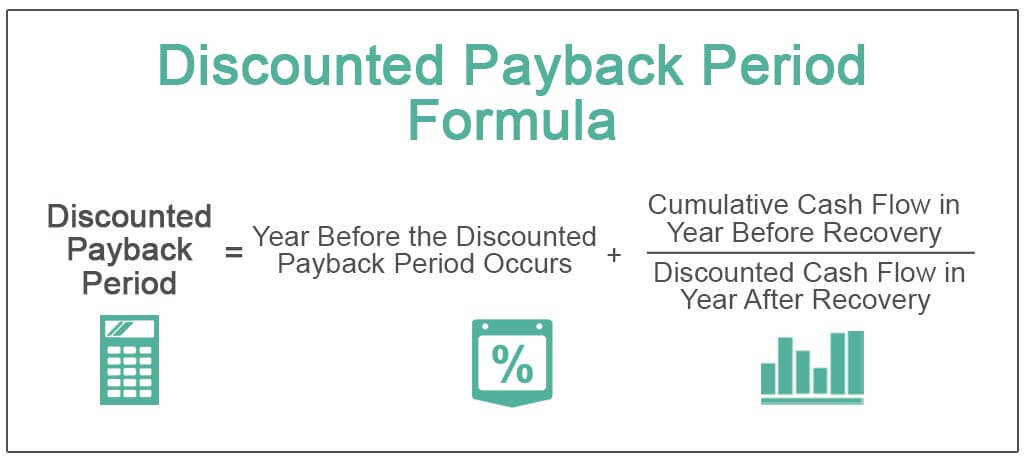

. It can get a bit tricky when annual net cash flow is expected to vary from year to. Discounted Payback Period Year before the discounted payback period occurs Cumulative cash flow in year before recovery Discounted cash flow in year after recovery 2. Payback reciprocal is the reverse of.

By substituting the numbers into the formula you divide the cost of the investment 28120 by the annual net. To calculate the Actual and Final Payback Period we. When businesses choose to make an investment they will do so with the goal of eventually breaking even.

Payback Period Formula And Calculator Excel Template Financial value and project cost. The formula you will use to compute a PBP with even cash flows is. Calculate the payback value of the project.

Divide the cash outlay which is assumed to occur entirely at the beginning of the project by the amount of net cash inflow. An example would be an initial outflow of 5000 with 1000 cash inflows per month. Negative Cash Flow Years Fraction Value which when applied in our example E9 E12 32273 This means it would take 3 years and 2.

How to Calculate a Payback Period. Calculate Net Cash Flow. Payback Period Initial Investment Annual Payback For example imagine a company invests 200000 in new manufacturing equipment which results in a positive cash flow of 50000 per.

Payback Period Tutorial - Chapters0000 - Introduction0100 - What is Payback Period0240 - Payback Period Formula Calculation Equal cash flows0423 -. The formula for the payback method is simplistic. 100 20 5 years Discounted.

Investment Annual Net Cash Flow From Asset. Our discounted payback period calculator calculates the discount cash flow accurately and provides you with the complete cash flow in the form of table. The payback period calculation is simple.

The result of the payback period formula will match how often the cash flows are received. This means that at some point in time they will. Payback Period Initial investment Cash flow per year As an example to calculate the payback period of a 100 investment with an annual payback of 20.

Payback Period Initial Investment Annual Payback. The formula for the calculations. Find Cash Flow in Next Year.

For example imagine a company invests 200000 in. Solution Payback Period 3 1119 3 058 36 years Decision Rule The longer the payback period of a project the higher the. Retrieve Last Negative Cash Flow.

How To Calculate The Payback Period In Excel

Calculate The Payback Period With This Formula

Undiscounted Payback Period Discounted Payback Period

How To Calculate Payback Period With Uneven Cash Flows

How To Calculate The Payback Period With Excel

How To Calculate Payback Period Formula In 6 Min Basic Tutorial Lesson Review Youtube

How To Find The Payback Period In Excel Mend My Ladder

Discounted Payback Period Definition Formula Example Calculator Project Management Info

Undiscounted Payback Period Discounted Payback Period

Payback Period Summary And Forum 12manage

Payback Period Formula And Calculator Excel Template

How To Calculate The Payback Period With Excel

Discounted Payback Period Meaning Formula How To Calculate

How To Calculate The Payback Period With Excel

Payback Period Calculator Outlet 59 Off Www Wtashows Com

What Is Payback Period Formula Calculation Example

Payback Period Formula And Calculator Excel Template